energy

Articles under the energy category.

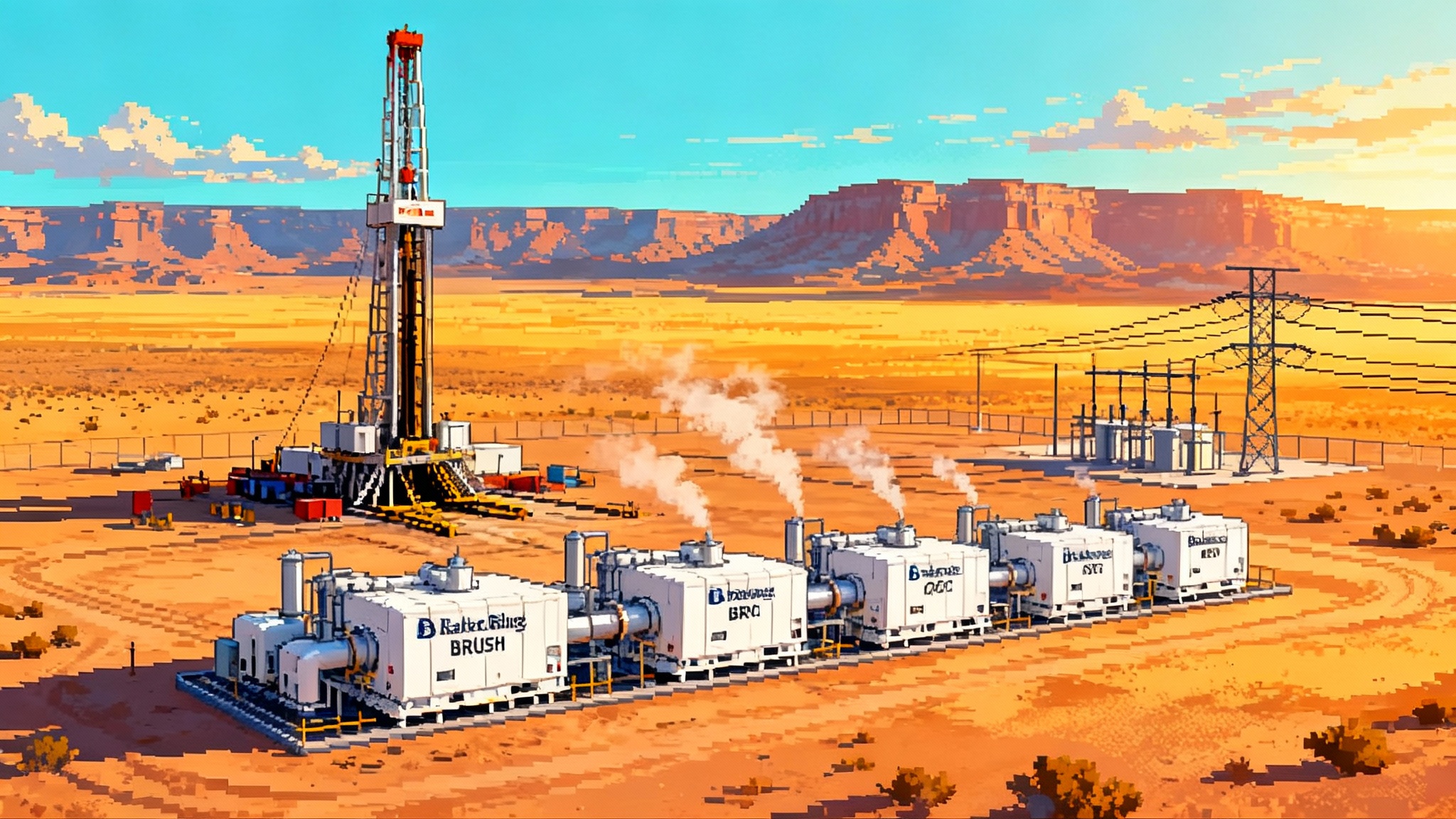

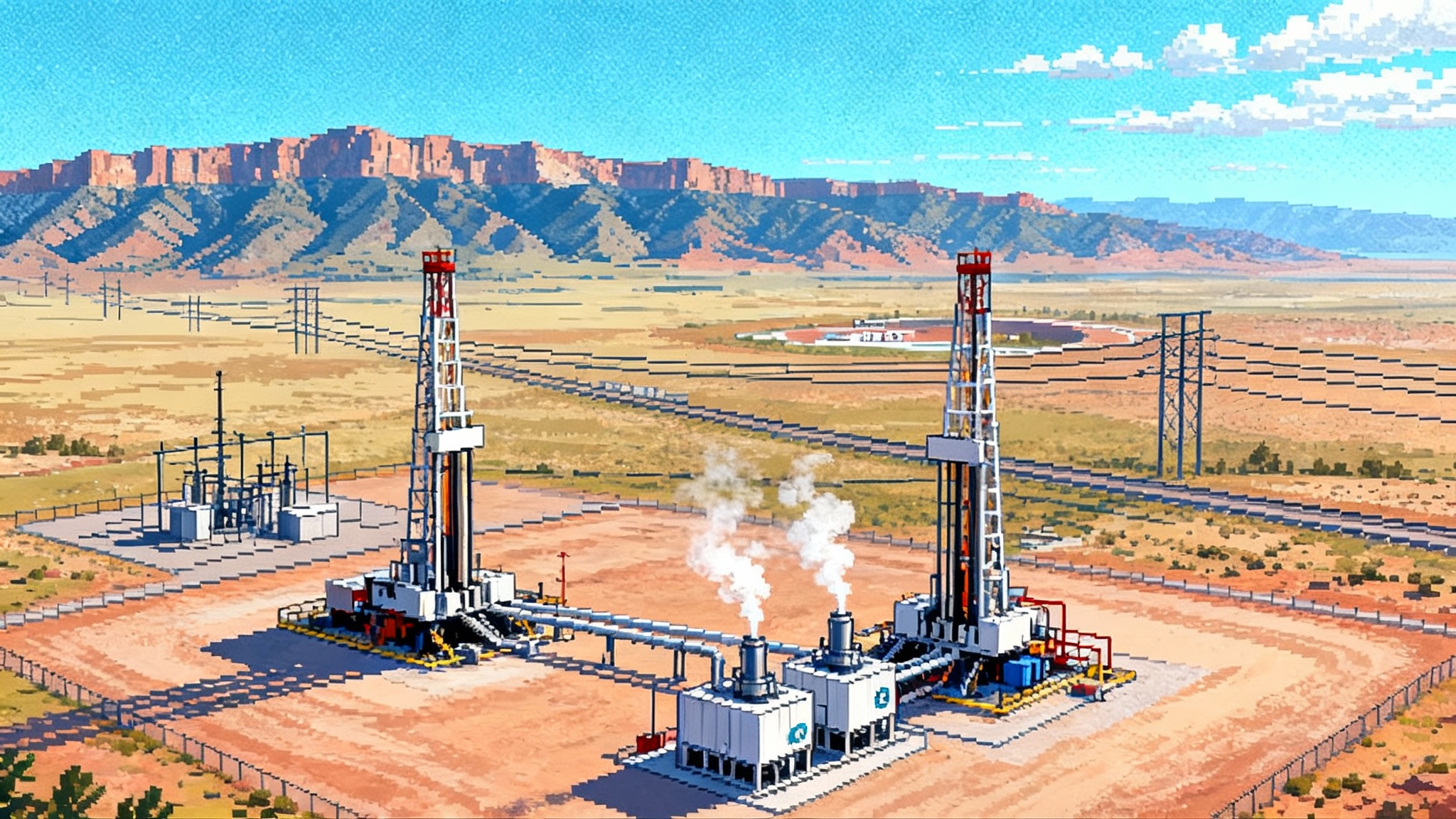

Geothermal’s 2025 inflection: Cape Station sparks oilfield build

Two milestones in 2025 push enhanced geothermal from pilot to program: a September equipment award for Cape Station Phase II and a June appraisal well that hit near 500°F at record depth. Here is how EGS plus ORC can deliver 24/7, fuel-free capacity across the West from 2026 to 2030.

FERC approves 2025 IBR rules that make grid support mandatory

FERC’s 2025 approval of inverter-based resource reliability standards turns grid support from best effort to requirement. This playbook shows developers, owners, and grid operators how to comply in 2025 to 2026 and convert upgrades into revenue.

LNG Whiplash 2025: CP2, Commonwealth and Delfin reset the buildout

Washington’s permit restart uncorked a wave of U.S. LNG approvals. Here is what can truly reach FID and first cargo by 2026–2030, and how it will ripple through Henry Hub, Europe, Asia, and shipping.

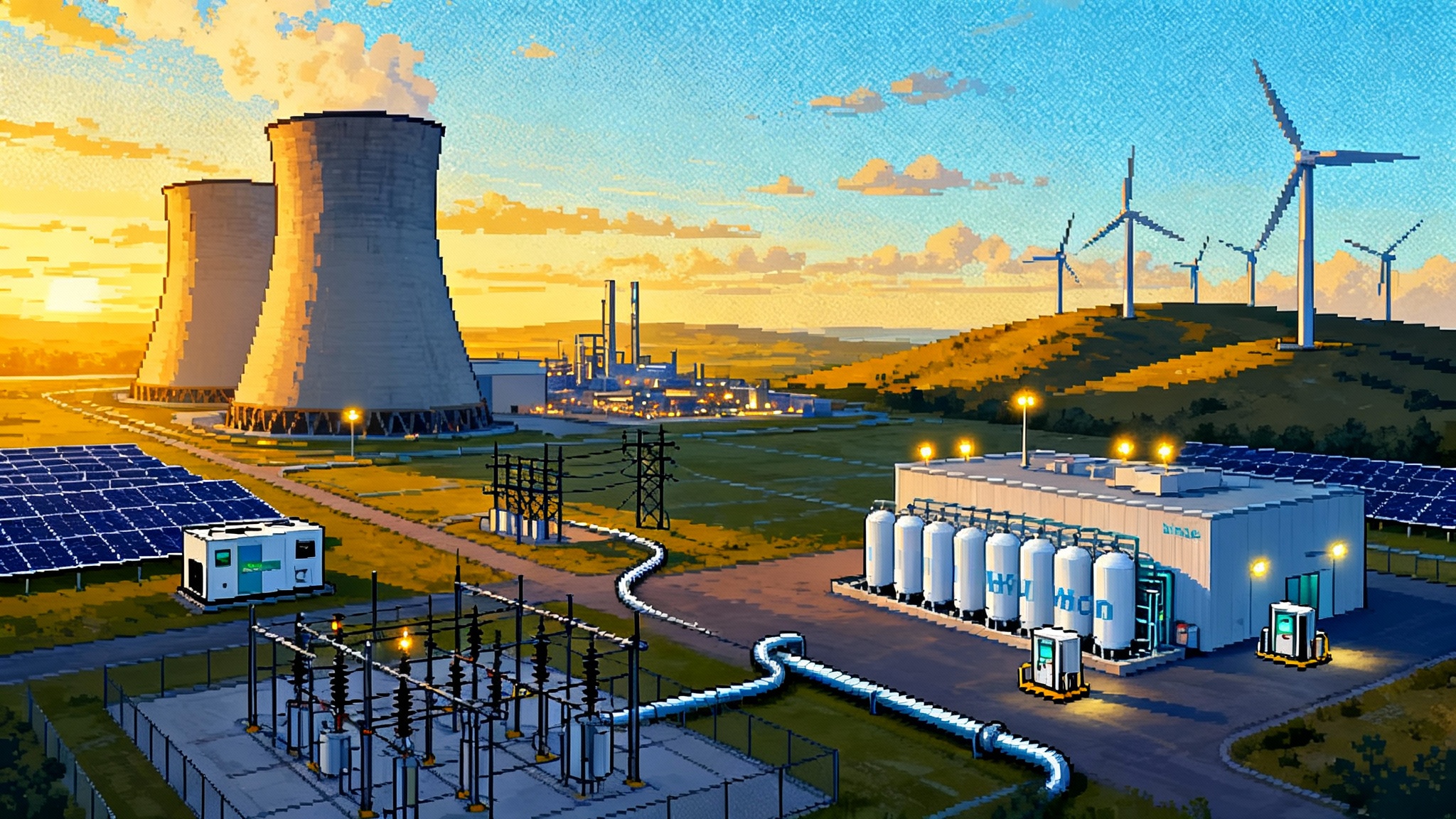

Palisades 2025: The Restart Playbook for U.S. Nuclear

Palisades is moving from decommissioning back to generation with a repeatable restart playbook. NRC sequencing, DOE-backed financing, and technology‑neutral credits point to a model that can scale brownfield restarts and site‑add SMRs.

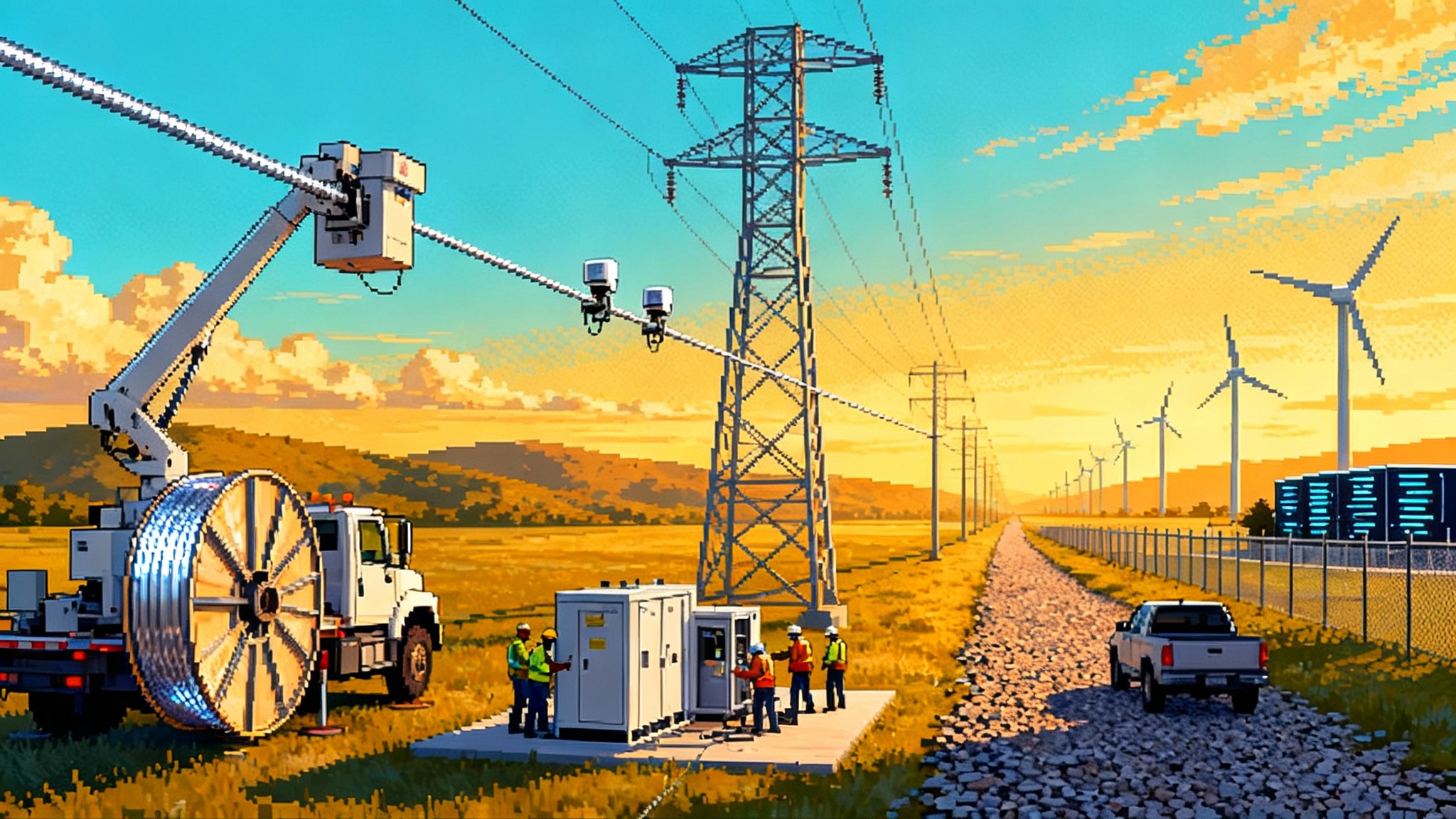

Order 881’s Moment: AAR, DLR and Grid Tech Hit Operations

Compliance deadlines are pushing the U.S. grid to refresh line ratings by the hour and bring dynamic sensors and topology tools into daily dispatch. Here is what changes next for operators, developers and investors.

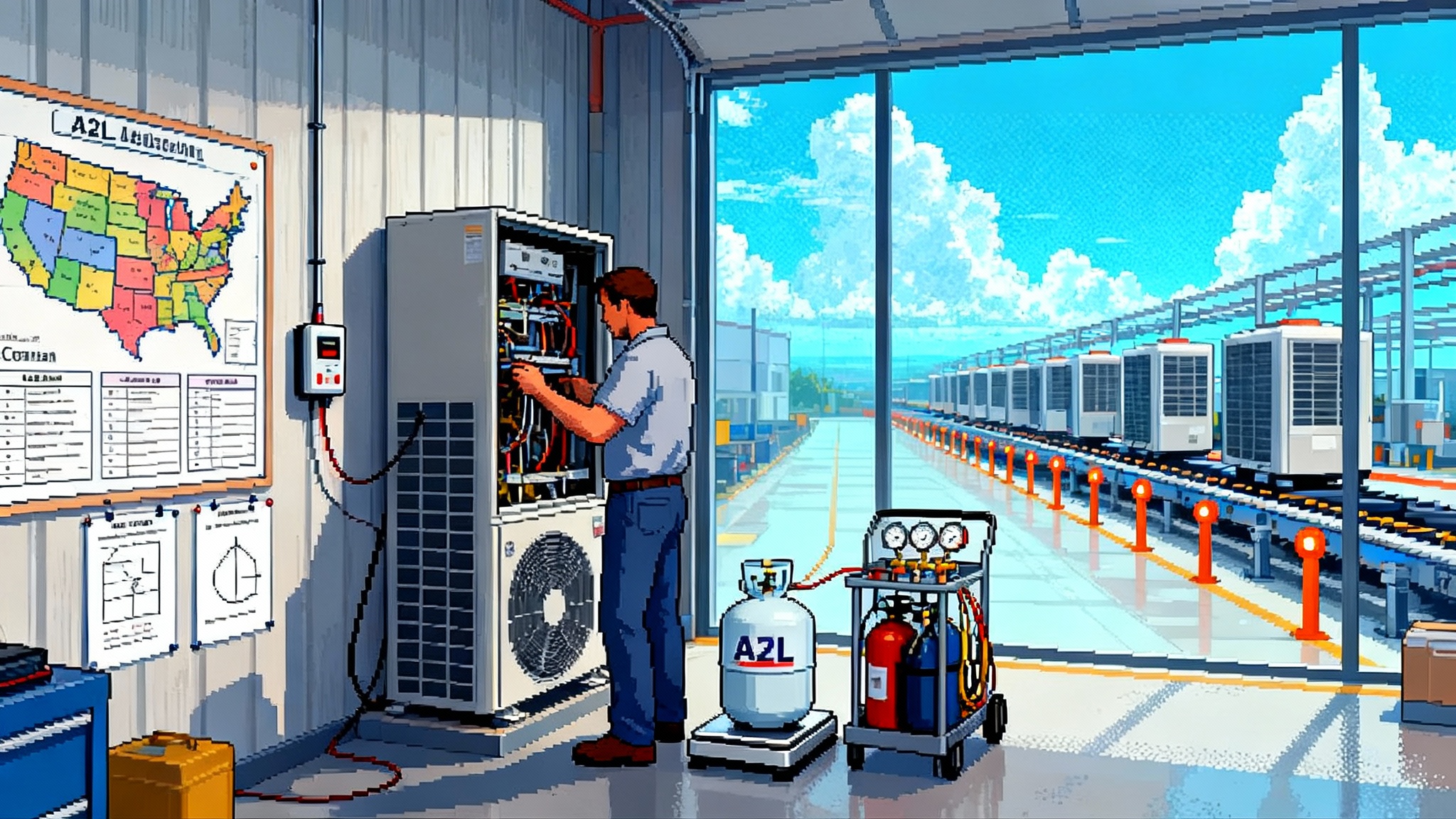

EPA’s 2025 A2L pivot: what it means for heat pumps and HVAC

In late September 2025 the EPA moved to revisit refrigerant rules that underpin America’s switch to mildly flammable A2L gases. Here is how the rethink could reshape heat pumps, codes, training, and the HVAC market through 2028.

Sodium‑ion’s U.S. shakeout: Natron collapses, CATL ramps

Natron Energy’s September 3 shutdown and CATL’s December ramp mark a turning point for sodium-ion grid storage. See what 2026 RFPs must require, how US manufacturing could localize by 2027, and where sodium-ion can beat LFP on cost and safety.

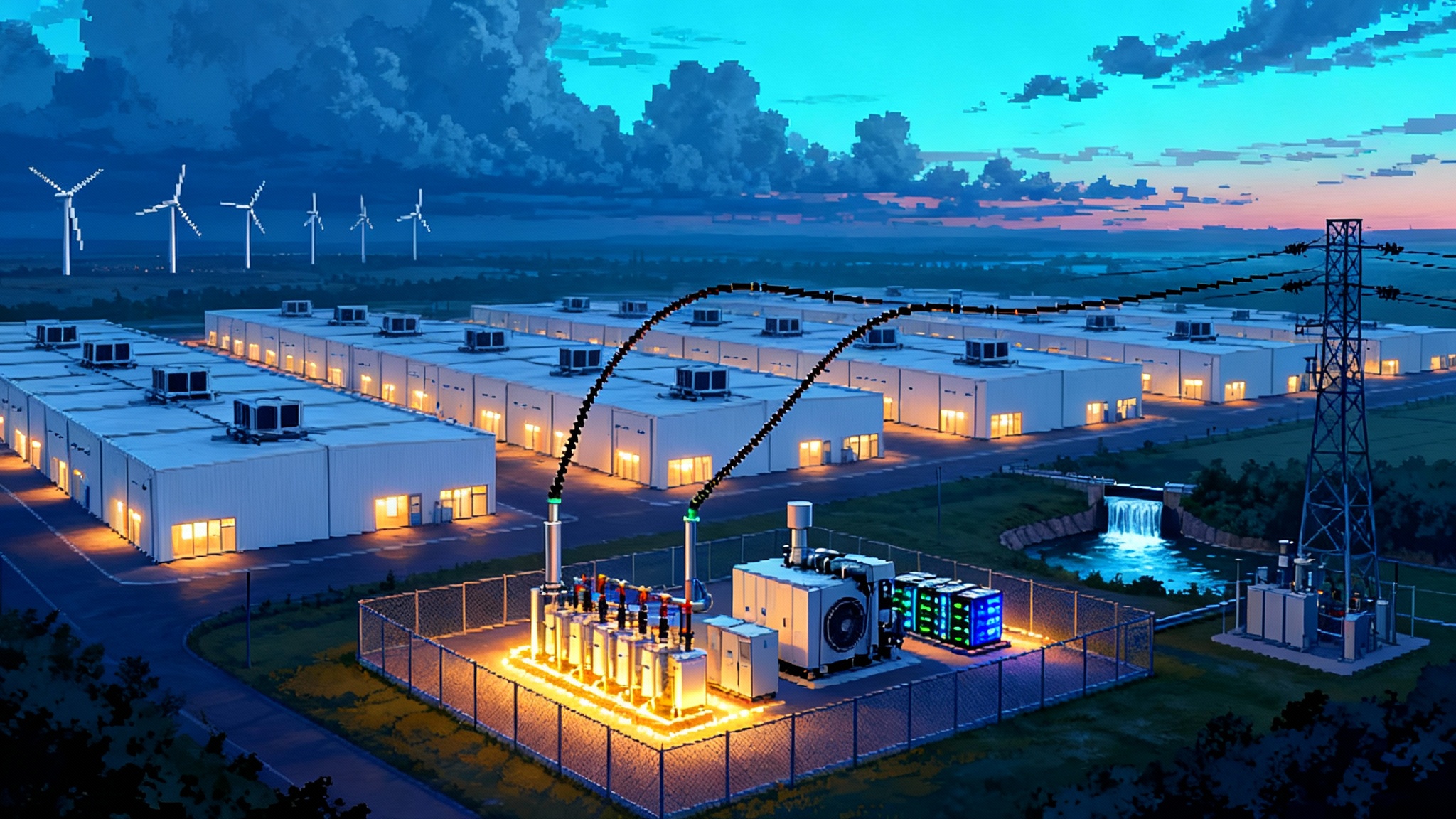

AI becomes the new baseload reshaping U.S. power grid

October 2025 delivered a clear signal. Fresh EIA and PJM forecasts point to record, round-the-clock electricity demand as AI data centers shift from edge case to everyday baseload. Utilities are racing to rewrite tariffs, interconnections, and supply strategies to keep up.

How 45V Finally Banks: Hourly Match, Storage, and Hubs

Published January 10, 2025, the IRS Section 45V final rule locks in annual matching through 2029, flips to hourly in 2030, permits storage‑backed EACs, and defines deliverability by balancing authority. This builder’s playbook shows how to site, contract, and dispatch financeable hydrogen projects through 2030.

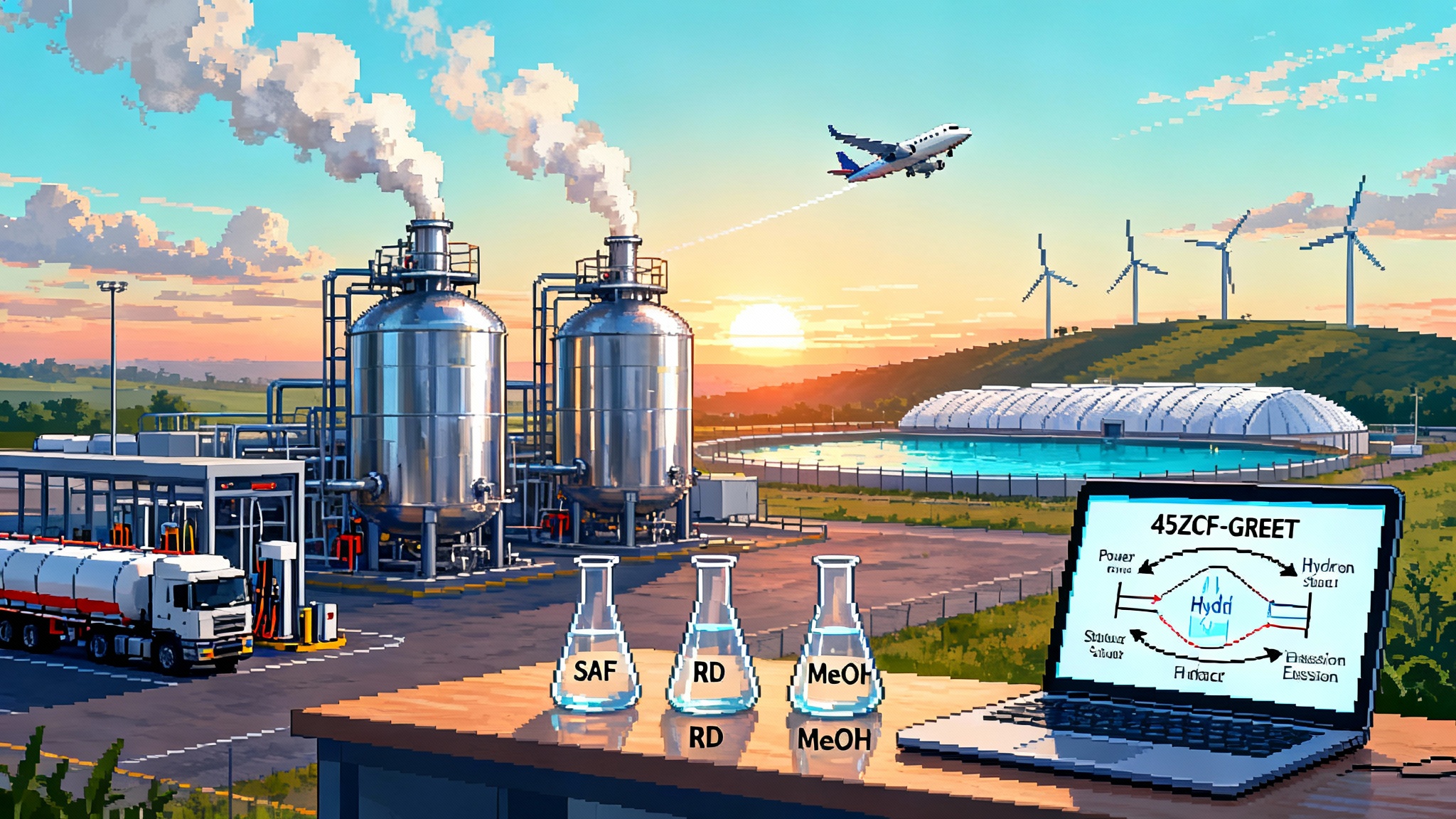

45Z Goes Live: A 2025 to 2027 Race to Ultra Low CI Fuels

Treasury and the IRS finalized how Section 45Z will work, turning lifecycle carbon intensity into dollars per gallon. Here is how the Clean Fuel Production Credit is already reshaping SAF, renewable diesel, methanol, and RNG-to-hydrogen before it sunsets on December 31, 2027.

The 2025 Transmission Reset: How Order 1920 Unlocks Capacity

With FERC Order 1920 in force, utilities are fast-tracking reconductoring, dynamic line ratings, and power flow controllers to free gigawatts on existing lines in 2025 to 2026.

EGS goes bankable: Cape Station’s 500 MW leap to 24/7

Fervo Energy’s Cape Station in Utah has pushed enhanced geothermal from pilot to bankable with major equipment awards, financing, and long-term PPAs. Here is the 2026-2028 commercialization roadmap and what it means for utilities and 24/7 buyers that need firm, clean capacity.

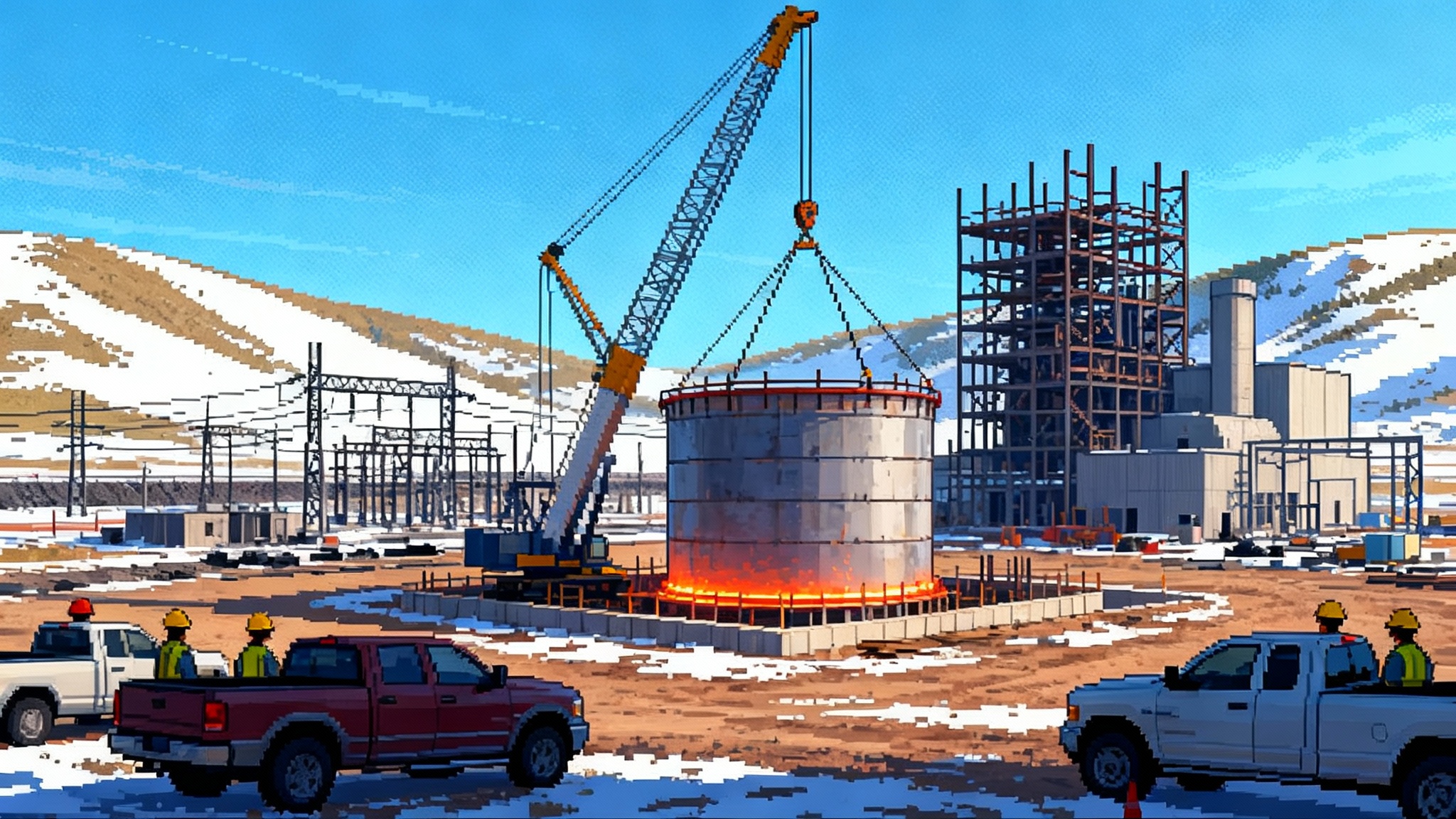

Natrium’s 2025 turning point: permits to poured steel

With an accelerated NRC review targeted for December 31, 2025 and Wyoming’s siting permit already in hand, Natrium is crossing from plan to construction. Here is what that inflection means for fuel supply, EPC execution, financing, and data center demand.

Cheap DOE 1706 Loans Are Rewiring the American Grid

Cheap federal credit under Section 1706 has kicked off a utility debt supercycle that lowers bills, hardens reliability, and moves power through existing corridors faster. Here is how the window through September 30, 2026 is reshaping what gets built first.

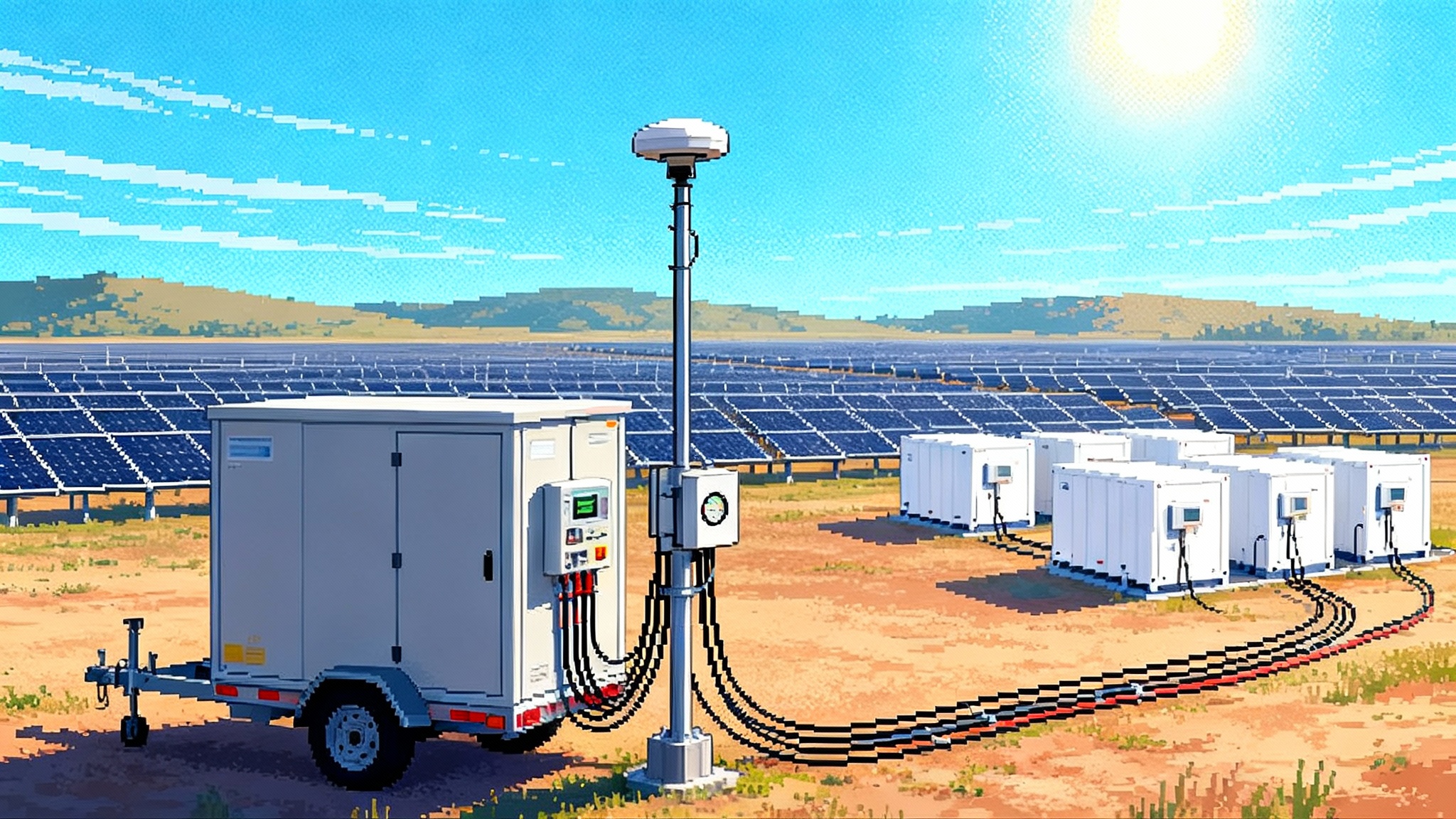

America’s 2025 Solar Tariff Shock and the Supply Chain Reset

New antidumping and countervailing duty orders on Southeast Asian solar imports took effect on June 24, 2025, and an August 29 vote opened probes into India, Indonesia, and Laos. Here is how prices, supply, and U.S. factory ramps will move next, plus the procurement plays that keep projects on schedule.

Seminoe Draft EIS puts GW-scale hydro storage on the grid map

FERC’s draft EIS for Wyoming’s 972 MW Seminoe pumped storage project signals a turning point for long-duration, synchronous storage. Here is how it can firm Rockies wind, fit into Order 1920 plans, navigate licensing, and reshape the West’s reliability playbook.

Summer 2025: Grid Batteries Become America’s New Peaker

Q2-Q3 2025 rewrote the peaker playbook. Batteries covered record evening peaks in California and Texas, set prices in critical intervals, and moved beyond pure arbitrage. Here is how longer durations, hybrids, and better rules can unlock the next 50 gigawatts.

Europe Becomes Methane’s Gatekeeper for U.S. Oil and Gas

With the federal methane fee effectively halted in March 2025, the center of gravity moves to Brussels. The EU importer rules start in 2025 and tighten in 2027, making real-time measurement and third-party verification the new ticket for U.S. LNG and shale.