energy

Articles under the energy category.

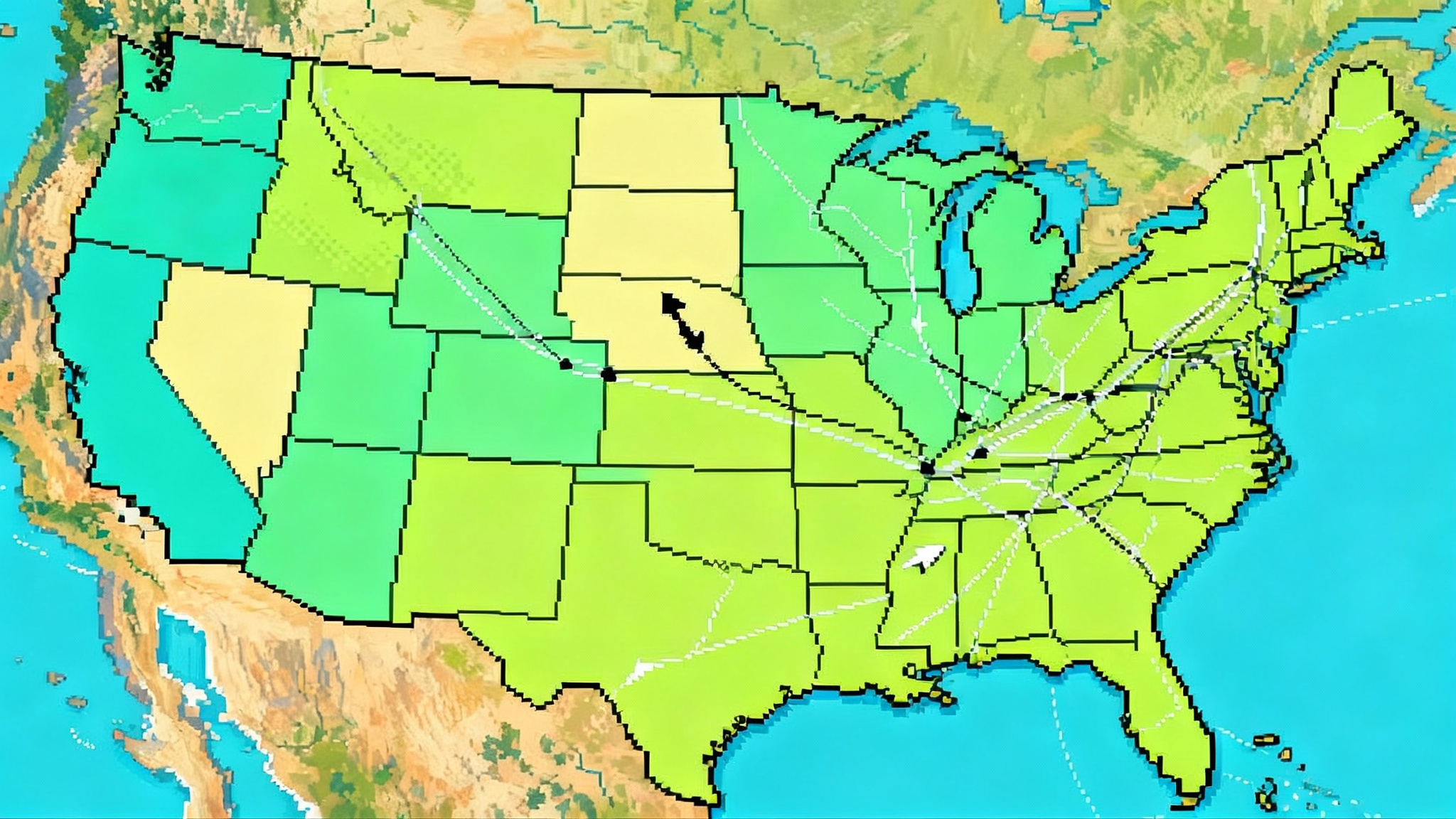

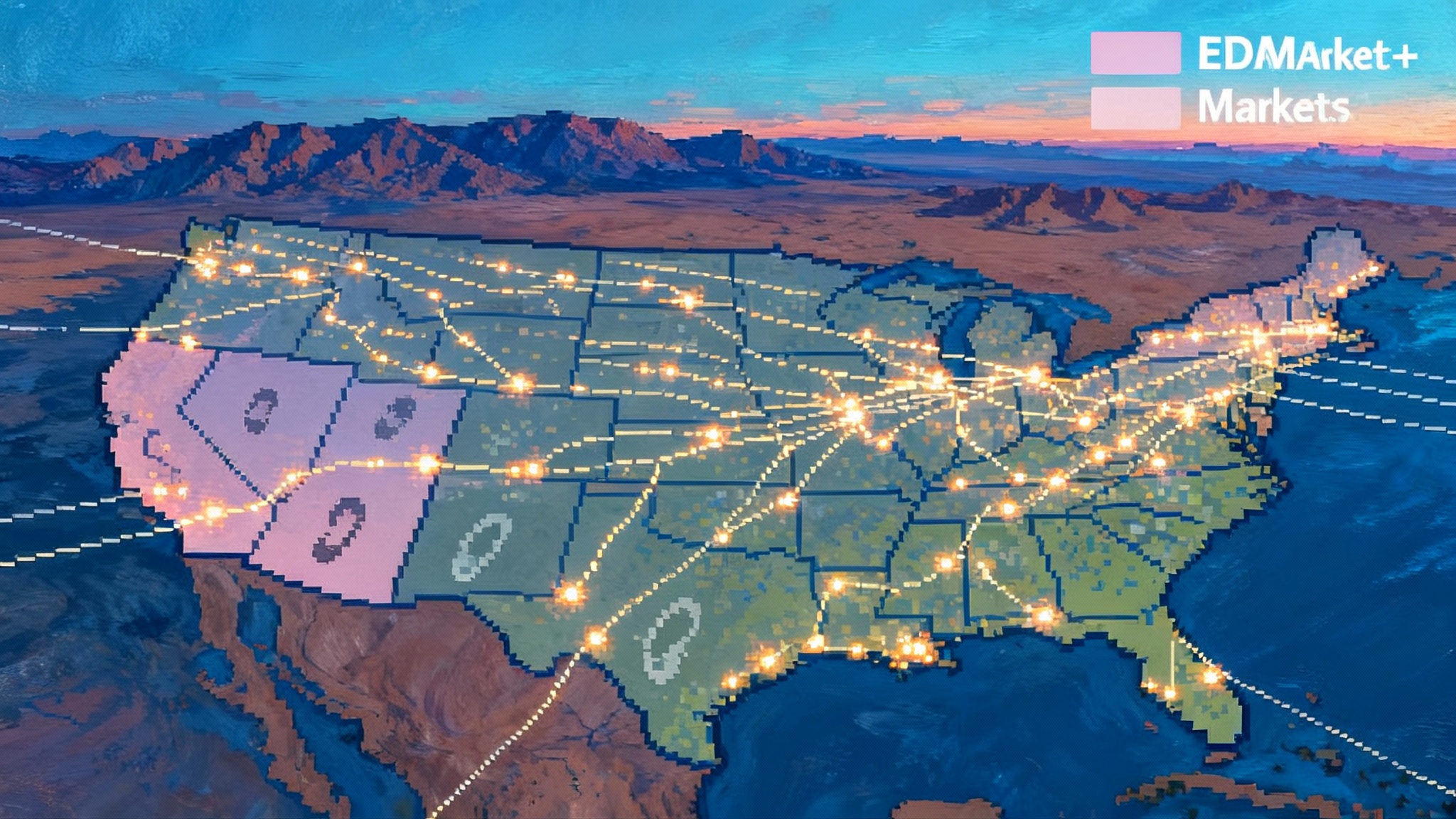

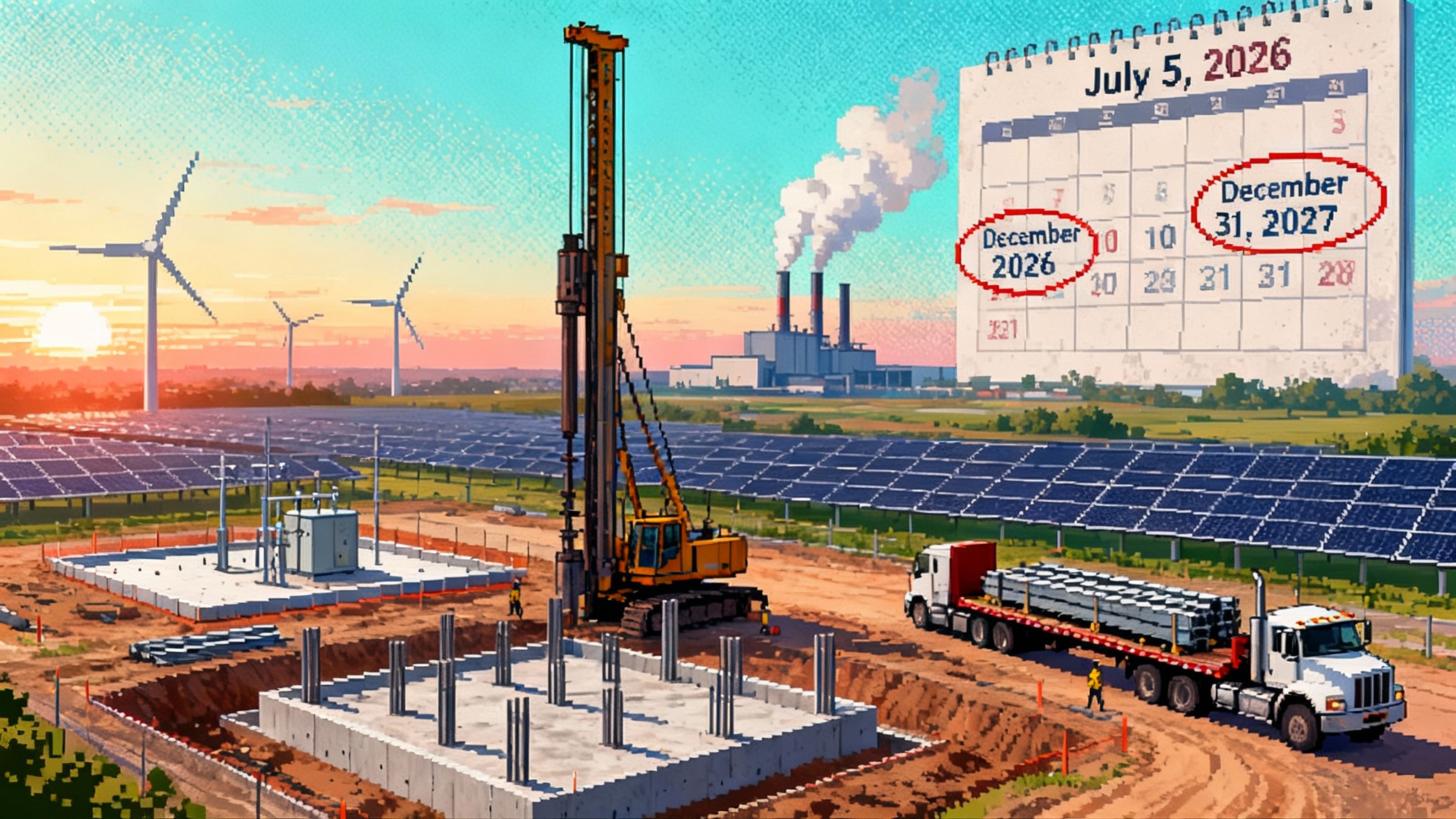

EDAM vs. Markets+: The West’s Two-Market Era Begins

FERC’s 5 approvals turned CAISO’s EDAM and SPP’s Markets+ from concepts into timetables. See the 2026–2027 launch windows, which utilities are lining up where, and how the two-market era could reshape prices, reliability and curtailment across the West.

NECEC goes live: 1.2 GW hydro reshapes New England winter

New England enters a different kind of winter. As NECEC begins delivering firm Hydro-Québec power, ISO-NE should see fewer price spikes, lower gas burn and emissions, and shifting capacity and REC dynamics that reward resources that perform in the cold.

June 2025 Tariffs Reset U.S. Solar: Prices, Risk, Timelines

New AD and CVD orders on Southeast Asian solar imports reset U.S. module prices and project timelines. Here is what changed on April 21 and June 24, how landed costs now stack up, who can fill the gap, and the moves to make in the next 90 days.

Texas Goes 765 kV: How ERCOT’s Grid Will Change by 2030

On April 24, 2025, Texas regulators approved new 765 kV import paths into the Permian Basin. Here is what that means for congestion, power prices, oilfield electrification, and the state’s data center buildout through 2030.

AI Load Rewrites the Grid as Coal Lingers and Gas Surges

AI-driven load and policy shifts are reshaping U.S. power planning through 2030. Federal signals slow coal exits, Texas funds dispatchable capacity, the Southeast resets timelines, and data center PPAs move from virtual to physical with capacity and fuel wraps.

Court Lifts Halt on Revolution Wind, Reprices Offshore Risk

A federal injunction restoring work on Ørsted’s Revolution Wind reshapes legal and financing assumptions for U.S. offshore wind. Here is how the ruling affects political risk, WACC, OREC and PPA clauses, insurance, and lender covenants in 2025–2026.

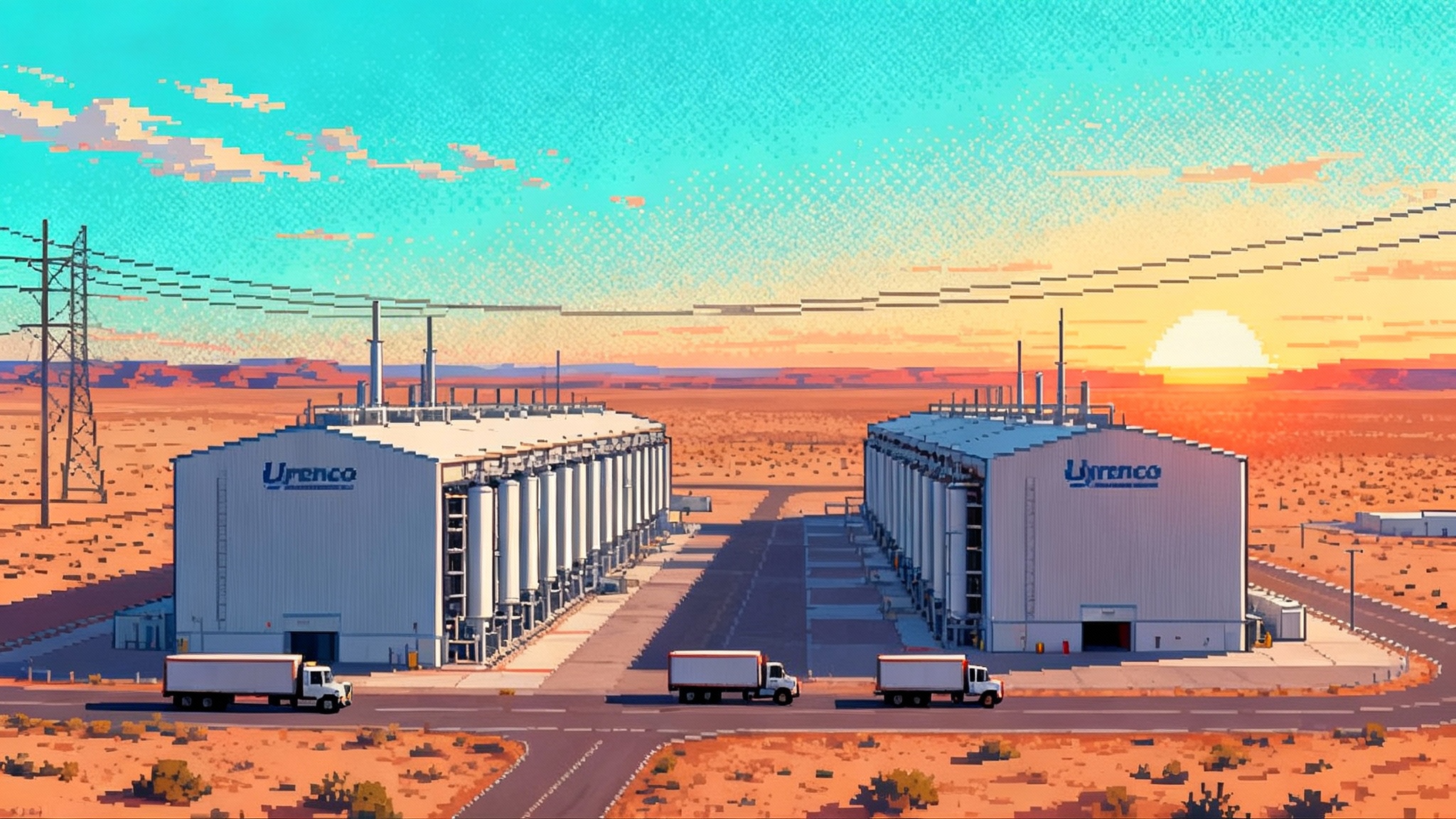

America’s Uranium Ban Triggers a 2025 Enrichment Sprint

With Russian enriched uranium blocked as of August 11, 2024 and waivers ending after January 1, 2028, the United States has launched a $2.7 billion push to rebuild fuel supply. Here is how 2025 is unfolding, who is winning and losing, and what to watch through 2028.

FERC’s 1920-A hands states the pen on grid planning

FERC’s 1920-A keeps the 2024 transmission rule intact, extends the launch of the first long-term regional planning cycles to as late as mid-2027, and elevates states in scenario design and cost allocation. See what utilities, RTOs, and commissions should do now, how it aligns with DOE’s NIETC process, and what it means for siting and costs.

45Z’s first-year shock: SAF stumbles, RNG surges

New IRS and DOE rules made Section 45Z real in January 2025. The math and registration timing are pushing value from sustainable aviation fuel to renewable natural gas. See who wins, who loses, and how to plan through 2027.

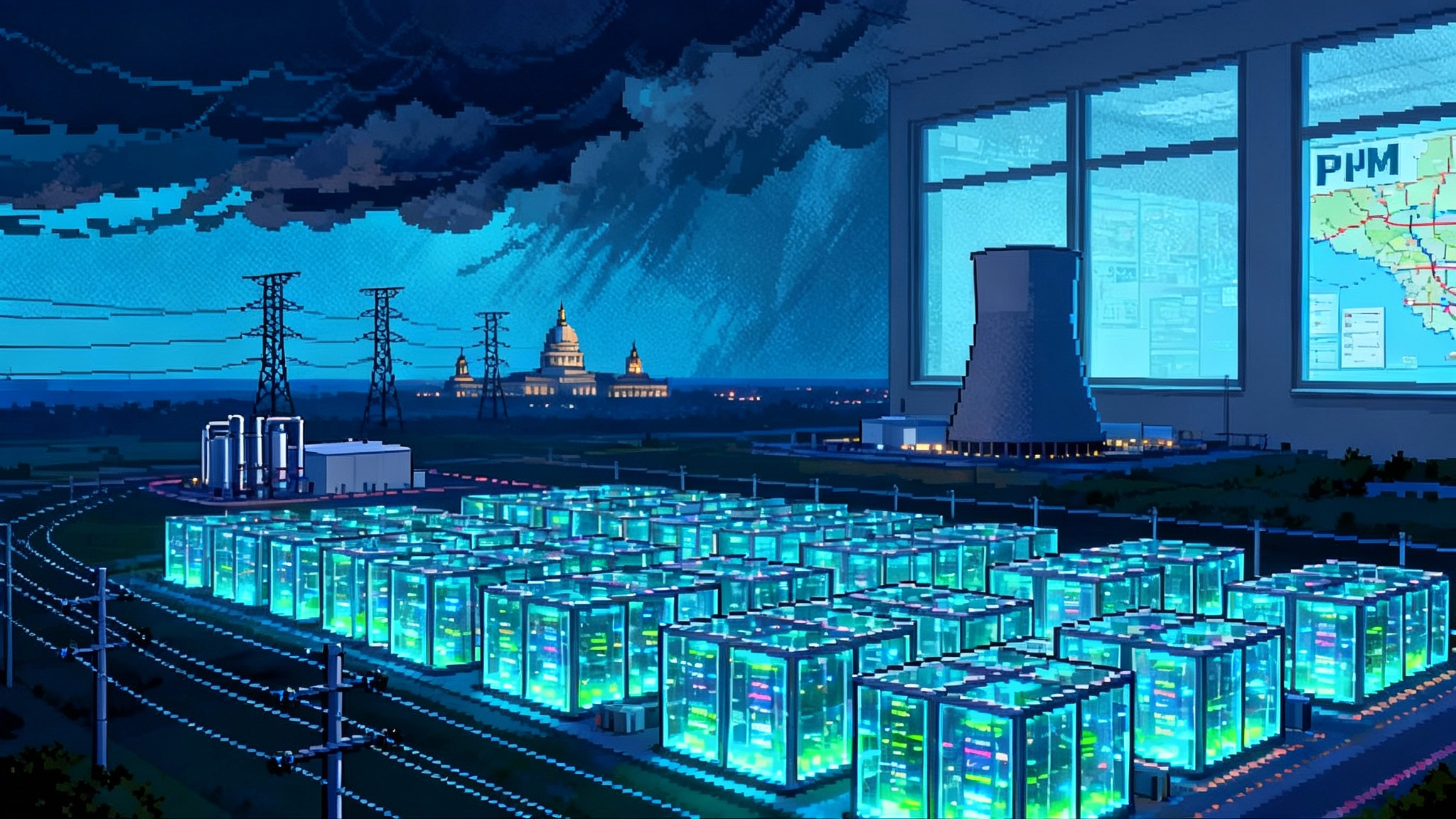

States vs. PJM: Data Centers Ignite a Governance Clash

AI demand and spiking capacity prices have jolted the Mid-Atlantic. Governors are challenging PJM’s authority, pressing for control over who pays, who builds, and which market rules will reshape the grid. Here is the playbook for the next two years.

EPA’s 2025 Data Blackout: How Power Markets Will React

EPA has moved to end federal greenhouse gas reporting and repeal power-plant CO2 standards, creating a national emissions data gap. Here is how state programs, utility planning, capacity markets, corporate procurement, and project finance will adapt next.

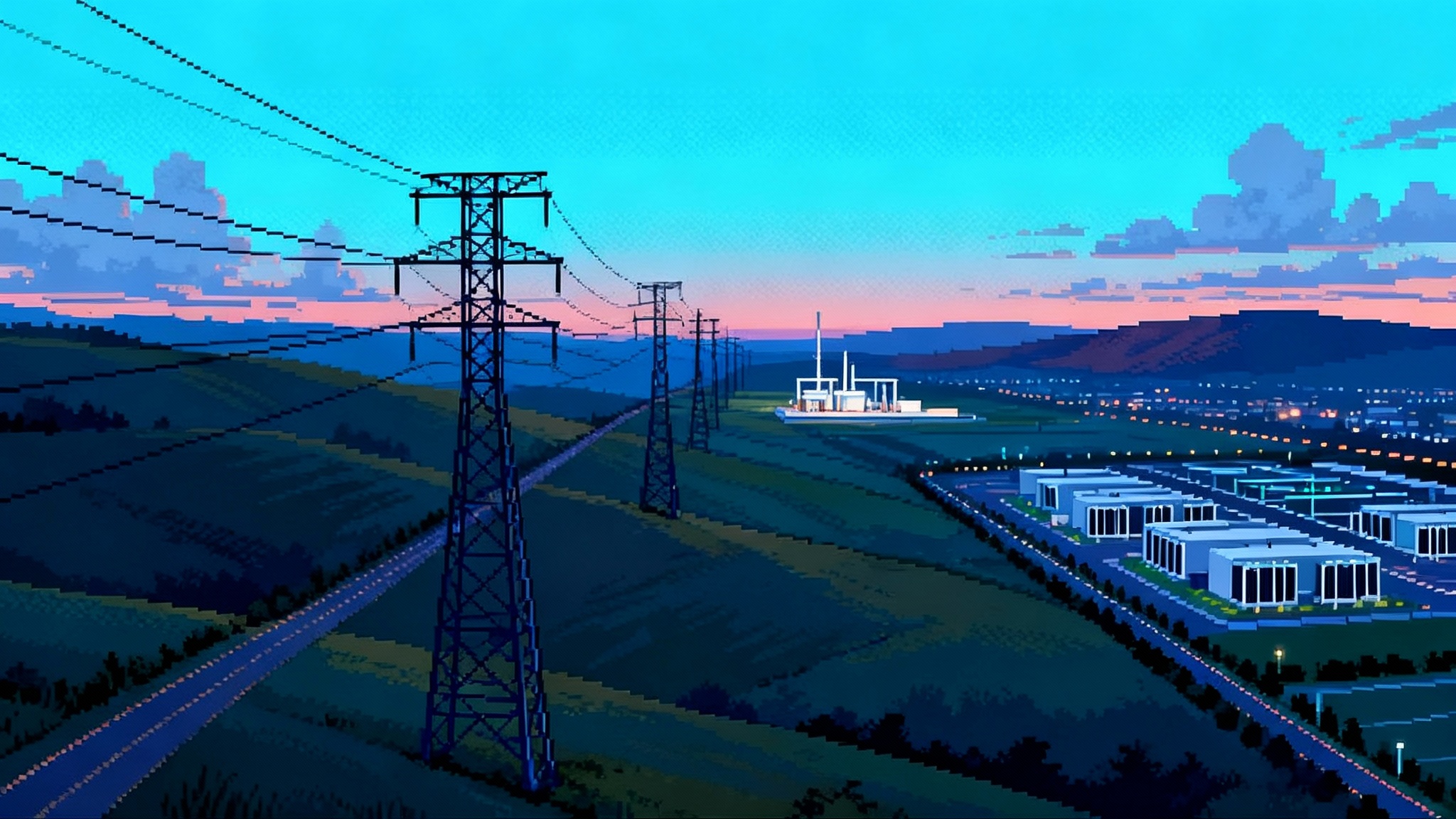

The West’s day-ahead showdown: EDAM vs. Markets+ by 2027

The West is splitting into two day-ahead hubs as CAISO’s EDAM starts in 2026 and SPP’s Markets+ aims for 2027. See who is joining which market, the go-live timeline, and what the split means for prices, reliability, congestion rents, and investment signals.

The 45Y/48E Crunch Resets U.S. Wind and Solar

Congress compressed the 45Y and 48E timelines and the IRS ended most of the 5 percent safe harbor. Here is what the July to September 2025 reset means for project finance, tax credit sales, supply chains, interconnection, M&A, and 2026 to 2027 build rates.

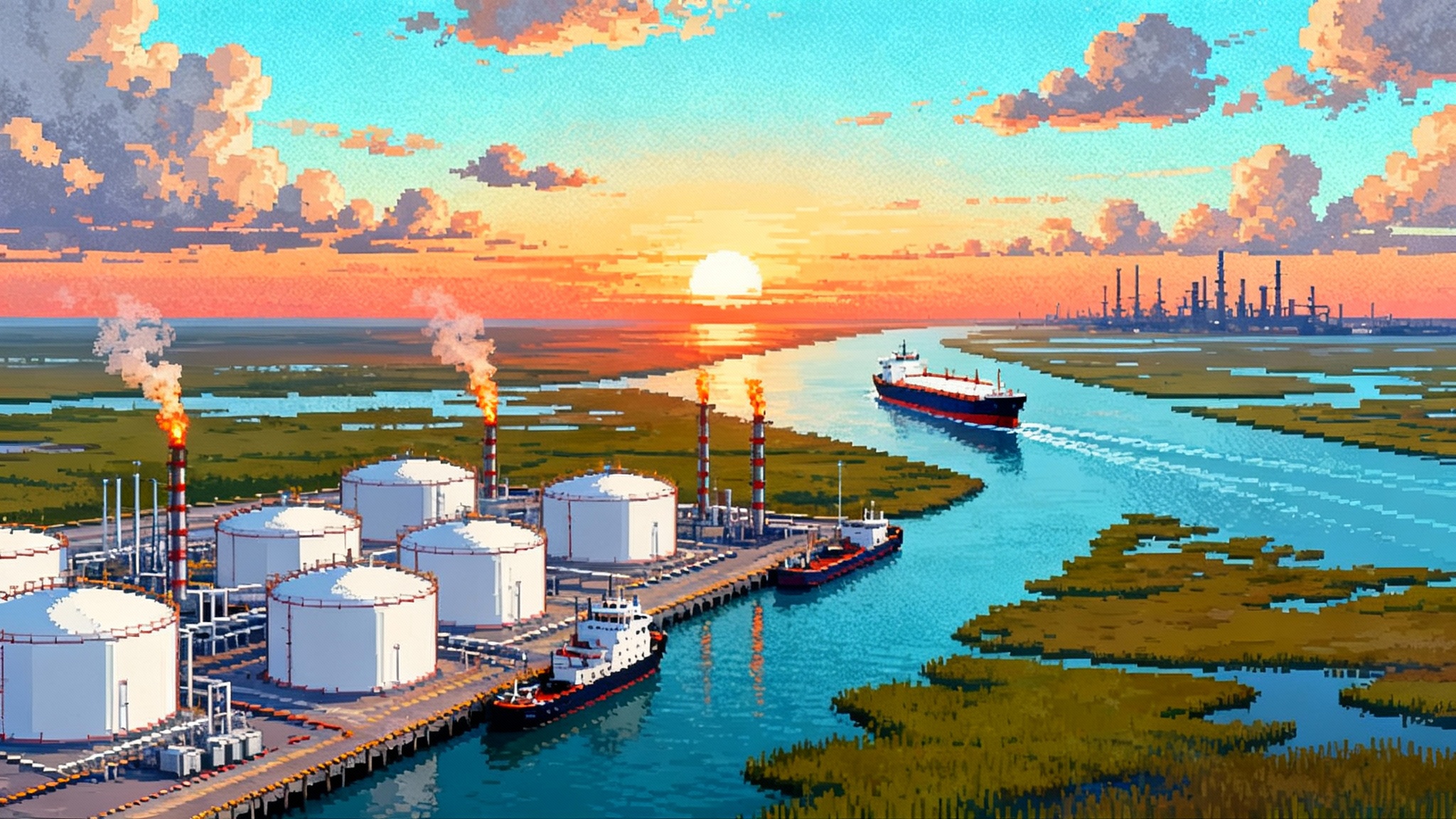

Shipping’s First Global Carbon Price Will Reshape Fuels

In April 2025 the IMO advanced a global carbon price paired with a fuel intensity standard that could upend refinery margins, LNG bunkering, and demand for green methanol and ammonia. Here is what changes by 2027 and who wins or loses.

U.S. LNG’s 2025 Reboot Meets Europe’s Russian Gas Pivot

DOE restarted LNG export approvals and eased commencement extensions, reviving Gulf Coast projects just as Europe moves to curb Russian LNG by 2027. Here is what it means for prices, ships, contracts, and risk.

After Methane Fee Repeal, Markets Rewrite the Rulebook on Gas

With Congress voiding EPA's methane fee and EPA removing it from the books, methane accountability is shifting to buyers, financiers, and states. EU import rules and satellite detection will reshape U.S. gas and LNG contracts, pricing, and market access in 2025-2027.

Hydrogen’s 2025 reset: 45V rules and the H2Hub shakeup

Treasury’s January 2025 45V rule extends annual matching through 2029, locks in 45VH2 GREET for carbon accounting, and tightens deliverability and verification. With DOE reviewing hub awards, early movers will favor firm power, hourly EACs, and sites that can prove grid deliverability by 2030.

HALEU’s turning point: America’s fuel plan gets real

June 25, 2025 put real fuel in play. Centrus delivered 900 kg of HALEU to DOE and won a production extension through June 30, 2026, just as the Russian uranium import ban that took effect on August 11, 2024 drives the market toward a hard stop on waivers by January 1, 2028.